The Contracts (Rights of Third Parties) Act 1999 has its day in the sun

- Details

Colin Ricciardello examines a recent Court of Appeal ruling on whether third party claimants could enforce a contract they did not know existed.

Colin Ricciardello examines a recent Court of Appeal ruling on whether third party claimants could enforce a contract they did not know existed.

Often the everyday contact with the Contracts (Rights of Third Parties) Act 1999 (“the Act “) is to exclude it. However, the Court of Appeal’s recent judgment in Chudley & Ors v Clydesdale Bank Plc (t/a Yorkshire Bank) [2019] EWCA Civ 344 offers a rare opportunity to visit the Act in greater detail.

In Chudley the Court of Appeal allowed the third party Claimants’ appeals, overturning the Commercial Court’s decision, and allowed the Claimants to enforce a contract to which they were not a party, did not have a copy of, or even knew of its existence when they became involved in the investments which were related to the contract they wanted to enforce.

Facts

The Claimants were private equity investors in what turned out to be a failed and fraudulent property investment scheme for the development of a golf resort in Cape Verde which included a development known as Paradise Beach. The Claimants were persuaded to invest their money in the Paradise Beach investment scheme operated by Arck LLP.

In its course of dealing with Yorkshire Bank, Arck and the bank had signed various Letters of Instruction (“LOI”). One was specifically for the Paradise Beach project (“PBLOI”) to the effect that the bank was irrevocably and unconditionally instructed to hold invested money in a segregated client account for the sole purpose of the Paradise Beach resort development and those monies could only be withdrawn on receipt by the bank of an unconditional undertaking from the lawyer for Paradise Beach (Olivera Martins –“OM”) which confirmed that the sums withdrawn would only be applied towards the Paradise Beach project costs and would be repaid on or before the redemption date of 1st August 2010.

The investment with agreed return was not repaid on the redemption date or at all.

Following Arck’s fraudulent withdrawal of the investors’ money from its Yorkshire Bank account, it had gone into liquidation and its principals had been prosecuted and imprisoned for fraud and forgery.

As it turned out, in breach of the PBLOI, the bank did not open the segregated account. It paid the investors’ money into Arck’s existing general account and their monies had been paid without the bank first receiving the undertaking from OM.

The Claimants were significantly out of pocket and, once they discovered the existence of the PBLOI and its breaches, they unsurprisingly brought a claim against the bank for breach of the PBLOI under the Act.

Section 1 of the Act

The Act allows someone who is not a party to a contract (“the third party”) to enforce its terms if:

“1 Right of third party to enforce contractual term.

(1) Subject to the provisions of this Act, a person who is not a party to a contract (a “third party”) may in his own right enforce a term of the contract if –

(a) the contract expressly provides that he may, or

(b) subject to subsection (2), the term purports to confer a benefit on him.

(2) Subsection (1)(b) does not apply if on a proper construction of the contract it appears that the parties did not intend the term to be enforceable by the third party.

(3) The third party must be expressly identified in the contract by name, as a member of a class or as answering a particular description but need not be in existence when the contract is entered into.”

In the Court below

The trial judge held that:

(i) The fact that the Claimants were not aware of the PBLOI at any material time did not preclude a claim to enforce that contract under the Act;

(ii) By reason of an unfulfilled condition precedent the PBLOI was not a binding contract between Arck and the bank;

(iii) If the contract had become binding then it could be enforced under the Act;

(iv) Even if binding and capable of enforcement, the breach was not causative of loss - being the bank’s “counterfactual” case of what would have to have happened if there was no breach.

In The Court of Appeal

Flaux LJ remarked that it was “…somewhat serendipitous that the appellants can take the benefit of the contract contained in the PBLOI, given that they were unaware of its existence at the time of their investment and when they first sought to recover that investment in 2010. “ However, knowledge of the contract to be enforced was held to be no bar to enforcement under the Act since the claim was not reliance based, as would be required in a misstatement claim. The claim was for breach of contract and “…it is not a requirement of the Act that a third party who is entitled to the benefit of a contract was aware of the contract at the time it was made or at any particular time thereafter.”

A striking feature was that neither party had argued in the court below that the PBLOI was subject to a condition precedent and there was no evidence given about what that condition was. The Court of Appeal held that in the absence of evidence, concluding that the PBLOI was subject to a condition precedent (and not binding for that reason) was an error in law.

In the bank’s Respondent’s Notice it contended that the trial judge was wrong to hold that the Claimants were identified. The bank argued there was no express identification in the PBLOI of the investor Claimants within the meaning of Section 1(3) of the Act by name, as a member of a class, or by answering a particular description. In addition the bank argued, to the extent that any identification was possible, that could only be done by process of implication which was inconsistent with the wording in section 1(3) which required express identification in the contract by name, as a member of a class, or as answering a particular description.

Like the Judge in the Court below Flaux LJ rejected these arguments and confirmed that the correct approach was to construe the contract as a whole viewed against the admissible factual matrix. He said that “… construing the LOI as a whole, it is clear that the reference to “client account” in the PBLOI was express identification of the class, clients of Arck who were investing in Paradise Beach, and the Appellants were within that class, so that the requirements of Section 1(3) were satisfied”.

Flaux LJ also held that there was no principled reason why that finding could not also satisfy section 1(1)(b) – being the requirement that the contractual term purports to confer a benefit on the third party. In this regard, Flaux LJ held: “The principal purpose of the LOI would seem to protect investors and, in that context, the provision for the opening of a segregated client account is clearly intended to benefit those investors by ensuring that their monies are held by the bank in a segregated client account subject to specific conditions”.

The bank won in the court below that for the claim under the PDLOI to be successful, it was necessary to prove the “counterfactual” – what would have happened if (i) the bank was not in breach of the PBLOI by paying into the segregated account, (ii) it had not wrongfully paid money out and (iii) the Claimants would have got their money back, since there was no mechanism for return of the money in the PBLOI. The Court of Appeal overturned this finding and Flaux LJ held that “… the loss suffered by the appellants as a consequence of the bank’s breach was the payment out of monies in 2009 without any OM undertaking. Contrary to the judge’s view, it was not a necessary part of the appellants’ claim that they demonstrate what would have happened to the monies if there had not been a breach”.

Conclusion

The judgment is of special interest to the issues of: (i) whether a contract adequately identifies the third party which is allowed to enforce it under the Act; and (ii) the requirements to prove loss caused in consequence of breach.

Colin Ricciardiello is a partner in the Projects team at Sharpe Pritchard, specialising in procurement and contract law disputes.

Sponsored articles

Walker Morris supports Tower Hamlets Council in first known Remediation Contribution Order application issued by local authority

Unlocking legal talent

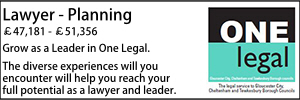

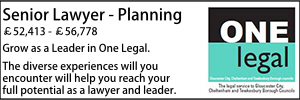

Lawyer (Planning and Regulatory)

Contracts Lawyer

Legal Director - Government and Public Sector

Locums

Poll