Driving the estate

- Details

The government's NHS reforms could have a significant impact on local authority estate asset management. Peter Hill looks at what is in store.

The White Paper Equity and Excellence: Liberating the NHS published in July 2010 set out a new vision for the NHS. The White Paper heralded great reform, proposing to change radically the nature of decision making for healthcare commissioning: turning it from top-down to bottom-up. The new National Health Service Act to implement the reforms is to pass through Parliament very soon.

Due for full implementation in 2013, the new bottom-up commissioning bodies for primary care will be General Practitioner (GP) consortia, with the remaining services to be commissioned by a new NHS Commissioning Board. Public health functions will pass to local authorities; PCTs and Strategic Health Authorities will disappear. Existing NHS Trusts will either achieve Foundation Trust status, or be re-organised by mergers so that all Trusts have Foundation status.

The developing market for health and community care

By the time the changes have been fully implemented, the split between commissioners of healthcare services and their providers will be complete. As this occurs, real competition should sharpen: there will be a much greater diversity of providers who may not be wedded to traditional ways of operating. In the coalition agreement, the government has signalled its expectation of much greater involvement of independent and third sector providers, and the aim of empowering every patient to choose any healthcare provider that meets NHS standards.

The changes will impact on estate asset management strategy: services may go mobile or be based around non-traditional locations. As care pathways are redesigned and cost pressures bite, the trend for moving services into the community will continue and remote working for health and social care professionals will proliferate. Cost savings from joint working and co-location will come to the fore. As the market develops and competition intensifies, both commissioners and providers will need better asset management skills to help deliver cost efficiencies and service improvements. Asset managers can expect a higher profile for what has traditionally been a low profile support service.

The detailed proposals for integration of PCTs with local authorities have yet to be announced, but it seems likely that ownership of the PCT estate will pass to local authorities. The process of integration of asset management functions will give rise to a number of issues: management structure and personnel for the combined asset management team, compatibility of databases and IT systems, alignment of budgets and agreement of a unified estate strategy and investment priorities. With pressure for cost savings so intense, rationalisation of the estate will be urgent.

It is clear that in future, achieving efficiency in asset management in the sense of good space utilisation and lowest lifecycle costs of an individual building, will not by itself be sufficient to achieve successful asset management. In future, asset management must also achieve success in effectiveness; that is to say, success in the contribution made by asset management to the organisation’s overall resource utilisation and performance standards in service delivery. The development of telecare services, new standards for patient accessibility, greater mobility in service delivery as well as recognised techniques for better space utilisation such as “hot desking” will affect the demand for, and type of accommodation needed.

For both the retained NHS estate and the PCT estate to be transferred to local authorities, there can also be little doubt that both organisational change and financial constraints will lead to a re-appraisal of what are truly core strategic assets, and a process of reshaping the estate over time.

Efficiency and cost savings – the whole local public sector estate

Transfer of PCTs’ public health functions to local authorities will mean that estate strategy decision making will be on a combined basis for all local authority service needs, including those for primary community care, but there is an even wider issue.

Opportunities for effective rationalisation of both the combined PCT and local authority estates will need to be considered in the context of the local public sector estate generally, and much greater emphasis will be placed on efficiencies achievable through joining up between local authorities and other public sector bodies. Through co-location of different public services where the relevant bodies are working jointly, rationalisation of the total local public sector estate offers the twin benefits of improved customer experience, and cost savings.

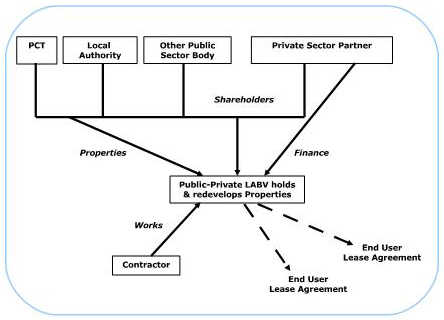

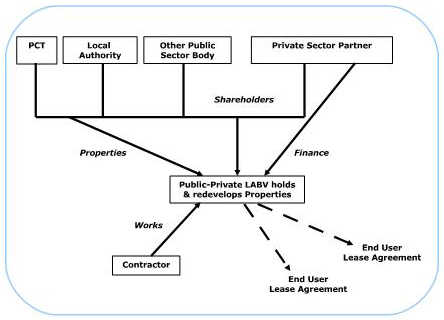

What asset management techniques would help to achieve these? A key issue is to find a suitable means for co-working public bodies to participate through a shared vehicle which can hold and redevelop property. If private sector capital is to be used, a Local Asset Backed Vehicle (LABV) may provide a solution (see Diagram). This is a form of public-private partnership which could be arranged to fit with e.g. a Local Enterprise Partnership.

The combined estates of a local authority and its PCT will contain a pool of assets which could be injected into an LABV, both properties ripe for redevelopment and income producing investments, which could provide security for finance to be raised by the LABV in order to carry out redevelopment. With an appropriate incentive for the private sector partner, the LABV could become a significant force for transformational change, delivering both rationalisation of the estate and a range of community benefits, reducing the local authority’s exposure to development risks and providing best value solutions.

Peter Hill is an Associate Director and Solicitor at TPP Law (www.tpplaw.com).

The government's NHS reforms could have a significant impact on local authority estate asset management. Peter Hill looks at what is in store.

The White Paper Equity and Excellence: Liberating the NHS published in July 2010 set out a new vision for the NHS. The White Paper heralded great reform, proposing to change radically the nature of decision making for healthcare commissioning: turning it from top-down to bottom-up. The new National Health Service Act to implement the reforms is to pass through Parliament very soon.

Due for full implementation in 2013, the new bottom-up commissioning bodies for primary care will be General Practitioner (GP) consortia, with the remaining services to be commissioned by a new NHS Commissioning Board. Public health functions will pass to local authorities; PCTs and Strategic Health Authorities will disappear. Existing NHS Trusts will either achieve Foundation Trust status, or be re-organised by mergers so that all Trusts have Foundation status.

The developing market for health and community care

By the time the changes have been fully implemented, the split between commissioners of healthcare services and their providers will be complete. As this occurs, real competition should sharpen: there will be a much greater diversity of providers who may not be wedded to traditional ways of operating. In the coalition agreement, the government has signalled its expectation of much greater involvement of independent and third sector providers, and the aim of empowering every patient to choose any healthcare provider that meets NHS standards.

The changes will impact on estate asset management strategy: services may go mobile or be based around non-traditional locations. As care pathways are redesigned and cost pressures bite, the trend for moving services into the community will continue and remote working for health and social care professionals will proliferate. Cost savings from joint working and co-location will come to the fore. As the market develops and competition intensifies, both commissioners and providers will need better asset management skills to help deliver cost efficiencies and service improvements. Asset managers can expect a higher profile for what has traditionally been a low profile support service.

The detailed proposals for integration of PCTs with local authorities have yet to be announced, but it seems likely that ownership of the PCT estate will pass to local authorities. The process of integration of asset management functions will give rise to a number of issues: management structure and personnel for the combined asset management team, compatibility of databases and IT systems, alignment of budgets and agreement of a unified estate strategy and investment priorities. With pressure for cost savings so intense, rationalisation of the estate will be urgent.

It is clear that in future, achieving efficiency in asset management in the sense of good space utilisation and lowest lifecycle costs of an individual building, will not by itself be sufficient to achieve successful asset management. In future, asset management must also achieve success in effectiveness; that is to say, success in the contribution made by asset management to the organisation’s overall resource utilisation and performance standards in service delivery. The development of telecare services, new standards for patient accessibility, greater mobility in service delivery as well as recognised techniques for better space utilisation such as “hot desking” will affect the demand for, and type of accommodation needed.

For both the retained NHS estate and the PCT estate to be transferred to local authorities, there can also be little doubt that both organisational change and financial constraints will lead to a re-appraisal of what are truly core strategic assets, and a process of reshaping the estate over time.

Efficiency and cost savings – the whole local public sector estate

Transfer of PCTs’ public health functions to local authorities will mean that estate strategy decision making will be on a combined basis for all local authority service needs, including those for primary community care, but there is an even wider issue.

Opportunities for effective rationalisation of both the combined PCT and local authority estates will need to be considered in the context of the local public sector estate generally, and much greater emphasis will be placed on efficiencies achievable through joining up between local authorities and other public sector bodies. Through co-location of different public services where the relevant bodies are working jointly, rationalisation of the total local public sector estate offers the twin benefits of improved customer experience, and cost savings.

What asset management techniques would help to achieve these? A key issue is to find a suitable means for co-working public bodies to participate through a shared vehicle which can hold and redevelop property. If private sector capital is to be used, a Local Asset Backed Vehicle (LABV) may provide a solution (see Diagram). This is a form of public-private partnership which could be arranged to fit with e.g. a Local Enterprise Partnership.

The combined estates of a local authority and its PCT will contain a pool of assets which could be injected into an LABV, both properties ripe for redevelopment and income producing investments, which could provide security for finance to be raised by the LABV in order to carry out redevelopment. With an appropriate incentive for the private sector partner, the LABV could become a significant force for transformational change, delivering both rationalisation of the estate and a range of community benefits, reducing the local authority’s exposure to development risks and providing best value solutions.

Peter Hill is an Associate Director and Solicitor at TPP Law (www.tpplaw.com).

Sponsored articles

Walker Morris supports Tower Hamlets Council in first known Remediation Contribution Order application issued by local authority

Unlocking legal talent

Legal Director - Government and Public Sector

Commercial Lawyer

Locums

Poll